Hello! Today, let's talk about investments. All of us since the children have accustomed to that to earn money, it is necessary constantly to go on work, to give it the physical and intellectual forces. Unfortunately, it is this model of behaviour that is the most common, typical of people.

But human capacity also has a limit. Besides, why does a person need money if he simply does not have time to spend it? He's always at work. That's it in this case when the money is, and there is no place to spend them, or when you need to multiply them, investments come to the rescue.What is an investment?

Investments are the investment of money in various financial instruments for the purpose of making a profit.

Let's take a look at examples of what investment is, what the essence of investment is:Example 1: Suppose you bought a laying hen, and then sell it at about the same price and get money for it. Investing it? Not yet.

Example 2: If you waited a while until the price of a chicken increases, and sold it already at a new higher price, you make a profit, it is already in some way an investment.

Example 3: You waited for the hen to take the eggs, and begin to sell not the chicken, but the eggs themselves. Sell them, sell them, and at some point the income from selling eggs begins to exceed the costs that you incurred to purchase the chicken. You start to make a profit: the hen carries eggs, you sell them, you get money. The hen again carries eggs, you sell them, again you get a profit. This is an investment in its pure form.

Example 4: You bought a chicken, she blew you eggs, you sold them, again bought a chicken. Already 2 hens bring you eggs that you can sell and receive money. And you can buy more and more chickens, they will carry more eggs, and you will have enough money to realize your needs and desires, to live provided only by controlling the process of purchasing chicken, selling eggs, and making a profit.

In the examples considered, a hen is understood as a source of income, that is, an asset, and under the eggs - the money income that the asset generates. All taken together chicken - this is capital or investment portfolio.

So, let's figure out what is an investment?

Investment is the art of multiplying money. In general, in order to explain what an investment is, one small article is not enough - too broad and multifaceted space hides behind this concept. In this article, we will try to reveal the essence and characteristics of an investment.

Why is this art? The fact is that successful investments cannot be learned by reading a smartbook or by performing a number of specific actions. There are no ways guaranteed to lead in the victory, but there is plenty of room for creativity for analysis and action. You will not meet two investors who invest 100% in the same way. Investors master this art and their own experience plays the main role here.

To understand what an investment is, imagine a chicken carrying eggs. These eggs carried by the hen we sell, and for the money we get we buy another chicken. Then again and again. As a result, we get a lot of hens that produce such a number of eggs, which is enough to realize all our desires and a decent standard of living. Under the chicken here is understood the asset, and under the eggs - income, the cash flow generated by the assets. A lot of hens are understood as capital, investment portfolio, which is growing due to the acquisition of new hens (assets).

It should be noted that investing is one of the few ways that leads to financial freedom.

The book, advised to read by experienced investors, is called "Reasonable investor", its author: Benjamin Graham. This classic book is about-investment - one of the few, worthy of attention in terms of investment (rather than speculation or something else). It was written long ago, several times reprinted, by the way, the most famous and wealthy investor, Warren Buffett, considers Graham his main teacher. It should be noted that some books may seem boring - you can recommend simply skipping the "uninteresting" chapters (especially if they tell of some narrow areas inherent only in the US)

In order to understand how to invest correctly, let's figure out what kind of free funds you can invest, where they can be invested (in what instruments), for how long, what profit can be made from each type of instrument, and what risk it all has.

In this case, calculate the maximum for all your expenses for credit, because the rate, which is indicated in all kinds of advertisements -

Plus it is necessary to consider, and if the business in which money was invested, will not earn, how it is necessary? If your money burns out? How will you pay the loan? All of these questions need to know clear answers before taking on such a burden.

Plus, this source of investment is that the right amount can immediately and in large amounts be on hand, and the downside is that for it, as for everything, have to pay, also with interest. The same can be said about borrowing money from friends or acquaintances: the instrument you are investing in may not yield profits, and the debt must be given in any case.

Investment is the art of multiplying money. In general, in order to explain what an investment is, one small article is not enough - too broad and multifaceted space hides behind this concept. In this article, we will try to reveal the essence and characteristics of an investment.

Why is this art? The fact is that successful investments cannot be learned by reading a smartbook or by performing a number of specific actions. There are no ways guaranteed to lead in the victory, but there is plenty of room for creativity for analysis and action. You will not meet two investors who invest 100% in the same way. Investors master this art and their own experience plays the main role here.

To understand what an investment is, imagine a chicken carrying eggs. These eggs carried by the hen we sell, and for the money we get we buy another chicken. Then again and again. As a result, we get a lot of hens that produce such a number of eggs, which is enough to realize all our desires and a decent standard of living. Under the chicken here is understood the asset, and under the eggs - income, the cash flow generated by the assets. A lot of hens are understood as capital, investment portfolio, which is growing due to the acquisition of new hens (assets).

It should be noted that investing is one of the few ways that leads to financial freedom.

What is an investment in its essence?

Investments are the investment of money for the purpose of making a profit. Making a profit is the goal of an investment. Investment has 2 important characteristics: risk and profitability. Risk and profitability are interrelated, and most often this relationship is directly proportional. That is, the higher the potential yield, the higher the risk of incurring losses. Risk-free investment does not happen - remember this! To be able to make a profit, you need to take a justified risk. By the way, if the risk of losses is high, and the chance to make a profit is small, then this is a bad investment. If you agree to a big risk, then the premium for it should be appropriate.Here are a few more theses explaining what an investment is

- Investments involve investing funds for a long period, calculated in years (as opposed to speculation on short-term price fluctuations).

- Investments are both in real assets (real estate, copyrights, business objects), and in financial (shares, fund units, bonds).

- Investments are equity (shares, share in the business) and debt (bonds, loans, loans). By the way, in accordance with this thesis, a person who took a loan in a bank becomes his object of investment, an asset of the bank that brings him a profit. So that!

- Investing, you invest, mostly money, and in the minority - time and effort.

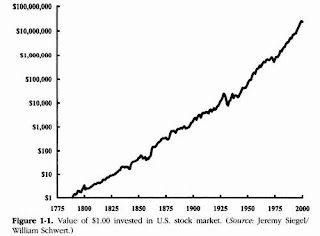

- Investments in shares for long periods of time are more likely to yield profits than losses. To confirm this thesis, take a look at the chart below: it shows that it would become with just one dollar invested in the US stock market. In 200 (!) Years $ 1, $ 10,000,000 would turn out. There is something to ponder ...

Question. What do you recommend to read on the topic of investment? |

Investing assumes that you invest free funds in an asset, and this asset brings you a one-time or systematic profit at any time.

First steps

Investing for no reason, without basic knowledge, is not worth it. Investing is only because "a friend invests money in there, he calls me with him" or because "on TV they showed and told how it is profitable and the TV does not deceive!" Will not lead to anything good.In order to understand how to invest correctly, let's figure out what kind of free funds you can invest, where they can be invested (in what instruments), for how long, what profit can be made from each type of instrument, and what risk it all has.

Sources of investments

To begin with, taking a loan, in order to invest - a bad idea. Investments are different, and in order to invest in opening a business, you often need to take out a loan.In this case, calculate the maximum for all your expenses for credit, because the rate, which is indicated in all kinds of advertisements -

Plus it is necessary to consider, and if the business in which money was invested, will not earn, how it is necessary? If your money burns out? How will you pay the loan? All of these questions need to know clear answers before taking on such a burden.

Plus, this source of investment is that the right amount can immediately and in large amounts be on hand, and the downside is that for it, as for everything, have to pay, also with interest. The same can be said about borrowing money from friends or acquaintances: the instrument you are investing in may not yield profits, and the debt must be given in any case.

But if you have free funds, savings, etc., and you are ready to not spend it, but to invest - go ahead! Plus the second source is that only you are responsible for your own funds, you won't - spend, you won't - invest, no one has to pay for it. The downside is that in order to collect a certain amount, you need to save up money \, which is often given with great difficulty. But with a small amount of money you can invest.

Where to invest?

We already wrote an article about where to invest money. In not we considered the most common ways of investing.In order to understand what you can invest in, it is first useful to determine what kind of investment you want to do. Different authors, science, and practice divide investments into a huge number of species, types with different characteristics, etc. It is important to know how investments are classified according to their main characteristics.

Types of investments

Depending on what you invest, that is, from the OBJECT of investing :Real investment is the purchase of new buildings, equipment, that is, of any material objects that can later generate profits, for example, investments in real estate. Also, investments can be directed not at the very purchase of material values, but for their repair.

In addition, real investment can be called the purchase of intangible assets, which can also bring profit: copyrights, patents, trademarks, etc. Even investing in education also refers to real investments.

Real investments are good because they have greater resistance to various market fluctuations, and in some cases also greater profitability compared to financial investments. Often the risks of loss of investments are also quite low: for example, even if any company you invested in went bankrupt, the investor always has an opportunity to recoup his losses by selling the property of the enterprise. This is not a frequent option, but it has a place to be.

Financial investments are investments in financial instruments, for example, in stocks, bonds, shares, etc., naturally, in order to make a profit. Financial investments can include even bank loans for business development, and in some cases even leasing.

There are also speculative financial instruments, for example, futures, options, indices, etc.

By the purposes of investment :

Direct investments are investments that are made with the aim of gaining control over an enterprise through the acquisition of a controlling stake in this enterprise.

Often, foreign investors make their investments for this purpose: the organization does not have the means to exist, an investor is urgently needed, it is not in its country, but foreign investors will happily invest in any prospective project, but only on the condition that the control the stake will remain with the investor, and in the future he will be able to make the main decisions on the company.

He does not fully buy it, but, in fact, gets full control over the enterprise. An attraction of foreign investments is popular in our country because of the fact that there are no promising projects in its own treasury.

Portfolio investments - investments in the "set" of securities, that is, in the so-called "portfolio". You buy several types of securities of various companies, and you have no goal to control the company, you just want to earn on the growth of the value of these securities. This is the so-called passive possession of securities.

And why not buy shares of one company, reliable? Why invest in several at once? The answer to this question is: why do many want to be owners of companies? Correctly. For the owner to work other people who by their work would bring profit to the owner.

The same can be said about portfolio investments: you are the owner of the Investment portfolio company, and your employees are the financial assets that work for you and you manage them. Employees (financial instruments) that do not bring you profit, you dismiss (remove from the portfolio), and those that work well, leave, and select new ones to increase cash flow. That's why you need portfolio investment.

Non-financial investments - related to the purchase of patents, licenses, copyrights, etc.

By maturity :

- Short-term investments are investments that will pay off and bring profit within a period of up to 1 year;

- Medium-term investments are investments that will pay off and bring profit in a period of one to three years;

- Long-term investments are investments that will pay off and will bring profit in a period of three years and beyond.

- Aggressive (high risk, high possible yield);

- Conservative (medium risk, average possible return);

- Moderate (low risk, low possible return).

Often a high risk deters investors, even in spite of high profitability. The solution to this problem can be diversification, that is, the division of its portfolio into high-risk, medium-risk, and low-risk assets.

Thus, you also have the tools for which you are most likely to make a profit, but small, and there are also those tools where you can make a big profit, but you do not necessarily get it at all. How to choose an investment strategy and how to diversify our portfolio, we will tell about this on our website.

The most important thing to remember when investing and assessing the possible risk: imagine that you lost all your invested money. Yes, take and imagine the worst outcome. And now think and feel, are you ready for this? How will you survive this outcome? What will you live on? What will you do next? Now if all these questions do not cause you nausea, headache, and colic - invest safely.

Pros and cons of investing

Pros of investing:- You can receive a stable and high profit, while you do not need to work on a regular job 24 hours a day

- Your main task is to choose the right investment tools, and they will make money for you.

- You can earn a lot of money in a relatively short period of time, however, it often depends on the initial amount of investment.

- Investment does not have a "ceiling", invest as much as you want and wherever you want.

- The opportunity to bypass inflation. In the CIS countries, official inflation is on average 10-15% per year, and unofficial for 30-40% per year. Not necessarily with the help of investment, you can cover all the inflation, especially unofficial, but at least some of your money can be returned.

- Investments protect not only from inflation but also from other cataclysms: a fall in the ruble or dollar rate, unemployment, etc.

- Investing as such automatically increases your financial literacy. This factor is often even more important than the revenues themselves. For example, if you take and restart the financial system: to take and distribute to all people for $ 10,000, then in a year a part of people will become millionaires, and a part - poor. And millionaires are more likely to be those who were rich before the "restart" of the financial system. And all because they are financially literate, they are able to manage their money and multiply them.

- Investing is always a risk. There is no risk-free investment. The one who tells you the opposite, apparently, really wants to deceive you.

- Investments "without anything", without starting capital does not exist. Initially, you need to have at least a small amount of money to invest.

- The opportunity to earn more often comes not just from the availability of starting capital, but also from its size. The more you invest, the greater the chance to make a greater profit. Risking is always better only with your money, and not with borrowing - suddenly you lose?

- Often, investments are perceived as a trifling matter, as something that does not take time and preparation. This is not true. In order to learn how to competently invest, you need time and money.

- If you do not have time to learn how to invest, you need to contact a specialist, which also costs money.

Conclusion

So, in this review article we looked at what investment is and learned that in order to invest, you need to have the means to do it. And better - strength, knowledge, and means.You can invest in various types of instruments, both in the real sector of the economy (business) and in the financial sector.

There are a great number of instruments for investing in each of the sectors, and all investments, depending on the investment terms, are divided into those that will pay off and will yield profits quickly, in the middle period, and for those that will have to wait for several years. In this case, usually, the more profit that can be obtained from the instrument, the higher the risk of losing all the invested money, and vice versa.

An uneasy business is an investment! But if you figure it out, it's worth it. The ability to correctly and correctly manage your monetary resources is difficult to overestimate because money in the modern world means the very opportunity to live.

1 Comments

I am wildblue Gmail setting expert. And I can do all the things in wildblue family that can best of the experts are doing. And I have more and more experience.

ReplyDelete